An element of any proposed merger of companies in Poland is determination of the ratio for exchange of shares of the companies participating in the merger and the amount of additional payments, if any, unless there is no exchange of shares. But sometimes the parties do not have to set a share exchange ratio in the merger process.

Share exchange ratio mandatory, with some exceptions

The Polish Commercial Companies Code specifies the minimum elements that must be included in the draft terms of a corporate merger. This document contains the most significant arrangements between the companies for carrying out the merger. The information required by the code frames the terms needed for the merger procedure, and is the basis for implementing the merger.

But for certain types of mergers, the code waives the requirement to determine the exchange ratio of shares of the companies participating in the merger. The merging companies do not need to include this element in the draft terms of merger when:

- The acquiring company acquires its subsidiary, in which it owns 100% of the shares

- One shareholder directly or indirectly holds all the shares in the merging companies

- All shareholders of the merging companies hold shares in the same proportion in all merging companies.

The last two points are the result of the amendments to the Commercial Companies Code that came into effect on 15 September 2023.

In simplified mergers of companies, the provision regarding the obligation to set a share exchange ratio is excluded by operation of law. This means that in the foregoing cases, the decision not to set a ratio does not depend on the companies participating in the merger.

However, the code also provides that this will not apply if no shares are exchanged in the course of a merger.

The need to determine the share exchange ratio in a reverse merger

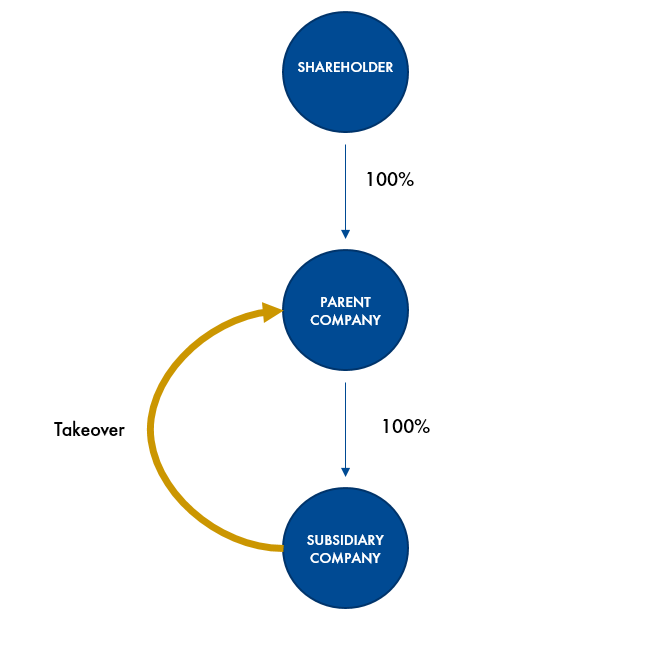

A reverse merger, otherwise known as a downstream merger, involves a subsidiary taking over its parent company or a company without such status but holding any shares in the acquiring company. An example of a reverse merger structure is shown in the illustration below.

As a result of a reverse merger, a shareholder of the company being acquired who also indirectly has held a certain number of shares in the acquiring company becomes a direct shareholder of the acquiring company.

As explained above, in situations where (i) the acquiring company acquires its wholly-owned subsidiary, (ii) there is a single entity above the merger, or (iii) all shareholders of the merging companies hold shares in the same proportion in all the merging companies, the obligation to determine the share exchange ratio in the merger plan is excluded by law. However, in the case of downstream mergers, there are structures where the code does not allow for the possibility of waiving inclusion in the draft terms of merger the exchange ratio of shares of the company being acquired for shares of the acquiring company. Therefore, determination of the share exchange ratio in a reverse merger is carried out pursuant to the same provisions as an “ordinary” corporate merger. Here, the code does not offer different regulations that could be applied.

The basis for determining the exchange ratio is a comparison of the value of the merging companies’ assets, which presupposes the need to value and compare them. The Commercial Companies Code does not impose a specific method for making such a valuation. As a result (especially with less complex ownership structures), companies take various approaches to the valuation, although they very often choose to use the carrying values of assets, as it is relatively straightforward, although it may leave out elements that affect the actual value of a company, such as its ability to generate income or the market position of the company. Therefore, it is also worth considering other recognised methods of business valuation, such as income methods (discounted cash flow), comparative methods (e.g. stock market multiples), or asset methods (e.g. adjusted net assets).

With more complex ownership structures, for example when the merging companies have other shareholders, or they hold diversified assets, there may be other rationales for using valuation methods other than the carrying value. In principle, establishment of a share exchange ratio where there is a complex ownership structure primarily serves to protect the shareholders of the merging companies.

An interesting situation arises when the assets of the acquirer are smaller than those of the target, as, in principle, in a reverse merger, the existence of such an asset arrangement would justify granting the parent company’s shareholders a smaller number of shares than they previously held in the parent company. Determining the share exchange ratio can pose difficulties, in particular when the methods adopted for valuing the companies’ assets are different.

The possibility of setting the share exchange ratio without any connection to valuation (i.e. on the basis of freedom of contract) is a contentious issue in the Polish legal literature. While some argue that the merging companies may invoke the freedom of contract in determining the ratio, some categorically oppose this possibility. The rationale behind the latter position is that the merger procedure cannot be compared to a sale of shares. Unlike a sale of shares, a merger can affect interests beyond those of the companies themselves (such as shareholders and creditors).

Therefore, if it becomes necessary to determine the share exchange ratio in the course of a corporate merger, serious consideration should be given to the best valuation method for all of the parties engaged in the process. Indeed, a method accurately valuing the companies’ assets should be the basis for determining the share exchange ratio. We analyse this issue in more detail in the article “What if the value or appraisal of assets changes during the course of a corporate reorganisation?”

Monika Lutomirska, adwokat, Waldemar Oryński, adwokat, Adam Strzelecki, M&A and Corporate practice, Wardyński & Partners