Redemption of shares as an alternative method of exit of a shareholder from a limited-liability company

Participation in a limited-liability company in Poland may end either as a result of acquisition of the shareholder’s shares by another entity or as a result of elimination of the shares, i.e. redemption. This mechanism is more and more common and used for various purposes in the course of M&A transactions consisting in the acquisition of only a portion of a company’s share capital. Then, it becomes an element of the shareholders’ agreement and thus of the articles of association which are to take effect and regulate the rights and obligations of the parties upon completion of the transaction.

Redemption of shares consists in the elimination of the shares, which means that the shares subject to redemption cease to exist. As a result of the redemption of shares, all rights associated with the shares (e.g. voting rights or dividend rights) are extinguished.

Importantly, redemption of shares can take place only if such a mechanism is provided for in the articles of association, either originally or as amended.

Types of redemption

The redemption of shares is not a uniform construction. Redemption can be broken down into the following types:

- Voluntary redemption, occurring with the consent of the shareholder whose shares are to be redeemed

- Compulsory redemption, occurring without the consent of the shareholder whose shares are to be redeemed

- Automatic redemption, occurring when a predetermined event occurs.

The various types of redemption are so different that it is worth pointing out the basic features of each.

Voluntary redemption

To carry out voluntary redemption, the following is necessary:

- Adoption of a resolution on redemption by the shareholders’ meeting

- Consent of the shareholder whose shares are to be redeemed

- Conclusion of an agreement between the company and the shareholder whose shares are to be redeemed, for the company to purchase the shares.

In the case of redemption of shares financed in the form of a reduction in share capital, the resolution of the shareholders’ meeting should be included in the notarised minutes. This form is not required for redemption from net profit (both of these methods of financing redemption are discussed below under “Methods of financing share redemption”), nor for redemption without consideration. At a minimum, the resolution of the shareholders’ meeting should indicate the legal basis for redemption and the amount of consideration due for the redemption of shares, except in the case where the shareholder has agreed to redemption without consideration.

Consent should be expressed to the company, but the regulations do not specify the form for such a statement of intent. Usually written form is recommended, e.g. by including the appropriate consent in the minutes of the shareholders’ meeting at which the resolution to redeem the shares is adopted, or in the agreement, as discussed below.

The agreement between the shareholder and the company should be in writing, with notarised signatures.

A voluntary redemption may be carried out for consideration or, with the consent of the shareholder, without consideration.

Compulsory redemption

To carry out compulsory redemption, the following is necessary:

- Occurrence of a prerequisite for compulsory redemption specified in the articles of association, and

- Adoption of a resolution by the shareholders’ meeting on redemption of shares, which, in addition to the elements indicated for voluntary redemption, should also include a justification.

This type of redemption is possible only if the company’s articles of association set forth in sufficient detail the prerequisites and procedure for such redemption. The case law indicates that the need to specify in the articles of association unambiguous prerequisites for the compulsory redemption of shares, without leaving a margin of discretion, distinguishes this institution from the exclusion of a shareholder, where the court assesses the existence of valid reasons that make it possible to issue a ruling excluding a shareholder from the company. The far-reaching consequences of compulsory redemption of shares justify the need to specify the prerequisites in the articles of association. It protects the interests of the shareholder and excludes situations in which shareholders are removed from the company through compulsory redemption merely because they are deemed undesirable or inconvenient. However, the Commercial Companies Code does not provide any guidance as to what events may constitute grounds for compulsory redemption, which means that, in principle, the parties to the articles of association may frame them according to their needs.

The grounds for compulsory redemption could be circumstances concerning the shareholder’s person, as well as events concerning the company. The former may prove particularly useful in the case where the redemption is intended to act as a sanction against the shareholder. For example, a prerequisite in the nature of a sanction might arise when the shareholder undertakes competitive activities (properly defined), acts to the detriment of the company (properly defined), loses specific qualifications, is convicted of a crime (properly defined), etc. If the shareholder is a natural person, the prerequisites may also relate to the shareholder’s death, so as to limit the set of persons who can join the company by inheritance. However, according to the legal literature, seizure of the shares in enforcement of a judgment, or the shareholder’s bankruptcy, cannot be grounds for compulsory redemption. As for company-related events, redemption can be useful for paying out profits when the company is currently operating at a loss.

As for the redemption procedure, the basic mechanism specifying that redemption requires a resolution of the shareholders’ meeting and describing the mandatory elements of the resolution is described in the Commercial Companies Code, and to a large extent the company’s articles of association may repeat the code provisions. However, depending on their preferences, the shareholders may add appropriate provisions, concerning for example the exact method of calculating the consideration for the redeemed shares, the exact timing of the payment, or the exact moment when the redemption occurs.

Similar to voluntarily redemption, compulsory redemption may be carried out for consideration or, with consent of the shareholder, without consideration. Unlike in the case of voluntary redemption, the code imposes a minimum amount of consideration for the redeemed shares: not less than the value of the net assets attributable to the redeemed shares, as shown in the financial statements for the last fiscal year, less the amount to be distributed to shareholders (the carrying value of the shares).

Automatic redemption

The last type of redemption is a type of compulsory redemption, as it requires:

- Fulfilment of an event (condition) specified in the articles of association, without the need for a resolution of the shareholders’ meeting, and

- Adoption of a resolution by the management board on the choice of the method of financing the redemption (through a reduction in share capital or from net profit).

According to the case law, the special nature of automatic redemption of shares requires introduction in the articles of association of strict designation of the event constituting the grounds for redemption, express exclusion of the need for adoption of a resolution by the shareholders, or granting authority to the management board in this regard. The event should be of a singular, objectively verifiable nature, allowing easy determination of the time of its occurrence. The determination of events whose realisation triggers automatic redemption must be so specific that there is no doubt about their substance and occurrence. As a consequence, the appropriate field of application of the automatic redemption of shares should be situations in which the redemption of shares takes place on the basis of precisely defined reasons, in the nature of events related to the company or the shareholder, and it is in the interest of the shareholders covered by the redemption. As indicated in the literature, for example, this refers to cases of non-appointment of a specific shareholder to the management board, removal of a specific shareholder from the management board, changes in the company’s object of business, or increase or reduction of share capital. Examples of such events may also include the expiration of a certain term or the shareholder’s death.

As with voluntary and compulsory redemption, automatic redemption may take place for consideration or, with the consent of the shareholder, without consideration. The code provisions on compulsory redemption apply to automatic redemption insofar as they relate to minimum consideration for the redeemed shares.

Methods of financing redemptions of shares

Except in the case where the redemption of shares occurs with the consent of the shareholder without consideration, the consideration due to the shareholder for the redeemed shares may be financed either through a reduction in share capital, or from net profit, or both of these methods may be used in combination.

The method of financing from net profit means that no reduction in share capital is necessary. As defined by the code, the net profit is the amount that can be distributed to shareholders. With this type of financing, there is no need for the lengthy convocation procedure (summoning the company’s creditors), which would take a minimum of three months, postponing the share redemption and slowing down the process of payment for the redeemed shares.

But financing the redemption by a reduction in share capital involves, among other things, the convocation procedure, which significantly postpones the redemption and payment of the consideration.

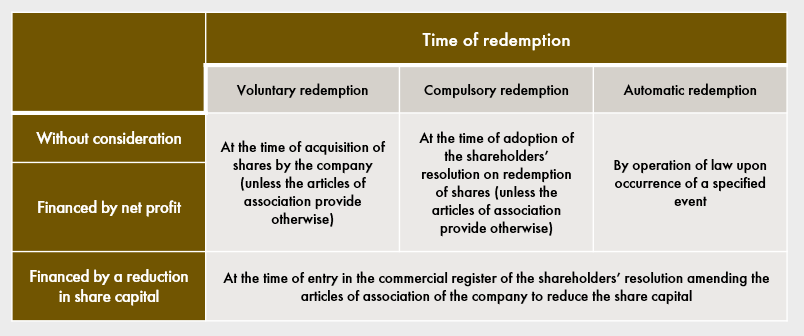

The moment of share redemption

The exact moment when shares are redeemed, i.e. annihilated from a legal point of view, varies depending on the type of redemption and how the redemption is financed. The table below shows the differences in this respect.

Objectives and functions of share redemption in M&A transactions

The mechanism of share redemption in M&A transactions allows for exclusion of a shareholder, including without the shareholder’s consent (in the case of compulsory or automatic redemption). This exclusion may be in the nature of:

- Sanctioning the departing shareholder as a “bad leaver” (e.g. the premise of engaging in competitive activities, acting to the detriment of the company, conviction of a crime, etc), or

- Allowing a shareholder or the shareholder’s heirs to exit the company (e.g. prerequisites in case of death consisting in redeeming all shares or only the shares that will be inherited by persons who do not meet specific requirements set forth in the articles of association, such as age, education or other qualifications of the heirs).

Therefore, this mechanism will be relevant when, after an M&A transaction, the shareholder structure is diverse, for example consisting of the majority acquirer and the company’s original founders as minority shareholders.

Given that the premises on which the mechanism of compulsory or automatic redemption is based can be framed quite flexibly by the parties to the company’s articles of association (provided that the premises are unambiguous), the mechanisms discussed in this article are perfectly suited for implementing the terms of a letter of intent regarding an M&A transaction, as well as specific provisions of shareholders’ agreements. But in each case, it is necessary to analyse alternative solutions that may prove more useful for achieving the parties’ aim. For example, where redemption is meant to serve as a sanction against a bad leaver, a share option mechanism (call or put) based on submission and acceptance of offers to buy or sell shares may be preferable, as it is not burdened by the requirement of minimum consideration equal to the carrying value of the shares, as in the case of compulsory or automatic redemption.

Krzysztof Drzymała, attorney-at-law, Marika Grzybowska, M&A and Corporate practice, Wardyński & Partners