Indexation of road and rail contracts

The rapid price increases for construction materials observed since the beginning of 2021 raises the question whether the indexation clause used in contracts for construction of roads and upgrading of rail lines in Poland will prove effective in practice. To make an assessment, we must understand the substance of the clause.

A mysterious formula

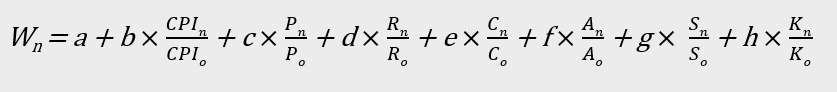

From the beginning of 2019, in contracts for road and rail projects in Poland, an indexation clause has been applied (Clause 13.8, Adjustments resulting from changes in costs). It boils down to the following formula:

That may look off-putting, but deciphering it is not difficult at all. This is primarily because the contracting authority, the General Directorate for National Roads and Motorways (GDDKiA), in cooperation with Statistics Poland (GUS), has launched an online calculator that automatically takes the necessary weights for calculations (variables from “a” to “h”) and indicators (“CPI”, “P”, “R”, “C”, “A”, “S” and “K”) and determines the amount of the indexation.

As a result, all one has to do is type into the form:

- The date of conclusion of the contract

- The date when indexation is to take place

- For road projects, the type of surface (asphalt or concrete)

- For rail projects, whether or not the contract includes the construction of an overhead contact line

- The amount to be indexed.

Inputting the data, we obtain a multiplier that is close to 100, e.g. a multiplier of 101.4854 means that the fee is increased by 1.4854%.

What does the formula hide?

However, this formula hides some secrets that are by no means mathematical in nature. According to the explanations for the formula, “a” is constant set at 0.5. Also, the sum of the variables from “b” to “h” must equal 0.5. What is the conclusion? Only half of the fee is subject to indexation. The other part, 50% to be exact, does not change at all, no matter how large the price fluctuation was.

The justification for the indexation of only half of the fee, published by GDDKiA on its website in a document entitled “GDDKiA’s position on comments submitted by industry representatives,” is as follows: “The 50/50 risk-sharing adopted between the parties to the contract prevents unfair market practices and reflects an equal risk-sharing between the parties.”

This explanation is not convincing. It is not clear what unfair market practices were meant here. However, the risk of a price increase in a contract for construction works should be borne entirely by the contracting authority, since it is the contracting authority that ultimately becomes the owner of the produced object. If something has become more expensive, the one who purchases the goods and services in question, not the one who produces them, should pay more.

Of course, there is a certain risk for the contracting authority, as due to price increases it may not have sufficient funds to pay for what it has ordered. But this is not a risk caused by the contractor, as it is mostly macroeconomic in nature. Therefore, it should be borne by the contracting authority, as the buyer ordering an object which, as a result of natural market processes, has simply become more expensive.

Obligations are established in the interest of the obligee, and it is the obligee’s interest that is subject to satisfaction, but this does not mean that the obligation must be performed at the expense of the obligor. The obligee should not be enriched at the obligor’s expense when performance of an obligation has become more expensive through no fault of the obligor, particularly when the obligee is de facto the state. After all, the state has at its disposal basic instruments contributing to price levels, such as tools for encouraging or inhibiting inflation (“CPI” in the above formula) or wage regulations (“R”).

The 5% limit

Clause 13.8 also contains a restriction that the total value of the fee adjustment may not exceed 5%, for either a fee increase or a decrease. This limitation is formally in line with Art. 439(2)(2) of the Public Procurement Law, but its level should be regarded as too low, especially as it is not an annual limitation but is binding for the entire period of performance of the contract.

This limit constitutes a sufficient guarantee for the contracting authority as regards the risk of lack of funds to pay for the ordered object due to drastic price increases. Therefore, there is no reason to index only half of the fee at a time.

There will also be problems with subcontractors

Art. 439(5) of the Public Procurement Law provides for the general contractor’s obligation to “change the fee due to the subcontractor” if the general contractor’s fee has previously been adjusted. The wording of this provision and its practical application will raise a lot of doubts.

First of all, the drafters seemed to forget that a change in the fee cannot be applied only by one of the parties to the agreement—here the general contractor. The subcontractor must also agree to it, which in the case of a reduction of the fee due to the indexation will be doubtful. Besides, when increasing the fee, the subcontractor’s consent is also needed, although in that case it will probably be easier to obtain it.

The relation of clause 13.8 to Art. 439(5) of the Public Procurement Law poses an even greater problem, as it is not clear whether a contractual indexation clause in a subcontract will exclude the application of Art. 439(5), or whether this provision is absolutely binding. It may be difficult to reconcile this provision with the requirement under clause 13.8 for the general contractor to include in the subcontract an indexation clause based on the above formula, but using only inflation (obligatory CPI) and another index selected at will. The result of an indexation under Art. 439(5) will be different from that under the contractual clause, and it will not be clear which result to give priority to.

A need to look for better solutions

Price fluctuations are normal in a market economy. Up to a certain level, these changes should not affect the fee at all. On the other hand, significant changes should be reflected in their entirety in the agreement of the parties, so as to restore the economic equilibrium disrupted by these changes. Clause 13.8 does not achieve this purpose, as it works exactly the opposite: it reflects well small price fluctuations, but not large ones, because the maximum indexation amounts to only 5% of the contract value and the adjustment is literally only “half.”

A decision to acquire a specific asset taking time to produce involves the risk that the cost of producing it will increase in the future, as the contracting authority ultimately becomes its economic owner. If there was a price increase, then the value of the object that the contracting authority acquires and that remains its property has also increased. Moreover, the contracting authority, belonging to the broader public sector responsible for macroeconomic and social policy, is responsible for price changes to a greater extent than the contractor. Therefore, the economic cost of price increases in public procurement should be borne in full by the contracting authority, which does not preclude the notion that up to a certain low level of price adjustments of no more than a few percent, no indexation takes place at all. If known from the beginning and precisely defined, such a risk will be included by the contractor in the price. However, bigger changes should be reflected in full.

It is very good that indexation has become the rule in public procurement and for subcontractors performing these contracts. However, these solutions need to be continuously improved. Otherwise they will not fulfil their function and will continue to lead to economic friction between contractors and contracting authorities.

Dr hab. Marcin Lemkowski, adwokat, Dispute Resolution & Arbitration practice, Wardyński & Partners