A sudden return to deducting contractual penalties in public procurement

On 24 August 2022, without any grace period, Art. 15r1 of the COVID special act ceased to apply. In Polish public procurement, this means a repeal of the ban on deducting contractual penalties and claiming them from a performance bond, which had been in effect since 24 June 2020.

Art. 15r1 of the COVID special act (Act of 2 March 2020 on Specific Solutions for Preventing, Countering and Combating COVID-19 or Other Infectious Diseases and Crisis Situations Caused by Them) was perhaps the only provision of the special act in the area of public procurement introduced in the interest of contractors and not contracting authorities. (We wrote about how the Covid special act generally did not improve the situation of contractors in the article “The public procurement market does not need a special act for Covid or the Ukraine crisis.”)

The epidemic worsened the economic condition of businesses operating in the public procurement market. Therefore, the special act introduced provisions limiting the possibility of:

- Setoff of contractual penalties in the case of non-performance or improper performance of the contract

- Enforcing a contractual penalty by drawing on the performance bond

during the period of either epidemic threat or state of epidemic declared in connection with COVID-19 (and for 90 days from the date of revocation of the state that was last in effect).

According to the justification of the act introducing this ban, immediate enforcement of contractual penalties (even disputed ones) by contracting authorities, whether by setoff against the contract fee or drawing on a bank guarantee, could lead to a loss of financial liquidity by contractors, “and as a result, their ability to win new public contracts, or to perform existing public contracts” (justification of the Act of 19 June 2020 on Interest Subsidies for Bank Loans to Businesses Affected by COVID-19 and Simplified Proceedings for Approval of an Arrangement in Connection with the Occurrence of COVID-19).

Who was hurt by the ban?

This restriction amounted solely to postponing the settlement of the contractor’s liability for improper performance of a public contract. For this purpose, Art. 15r1 provided for extension of time limits for contracting authorities to pursue claims, and extension of the expiration dates of performance bonds.

A state of epidemic was introduced in Poland on 20 March 2020, by virtue of a regulation of the Minister of Health of that date. Subsequently, on 16 May 2022, the state of epidemic was revoked, and a state of epidemic threat was introduced (regulation of the Minister of Health of 12 May 2022), which still remains in effect.

Relying on Art. 15r1, the public procurement market assumed that as long as the prerequisites existed for maintaining the state of epidemic threat in Poland, and for 90 days thereafter, unilateral enforcement of contractual penalties by contracting authorities would be limited.

But the drafters of the amending legislation determined that maintaining the restrictions “would have negative consequences for contractors and guarantors, as well as for contracting authorities, who may have problems enforcing accrued contractual penalties.” Contracting authorities and banks also lobbied for repeal of Art. 15r1. Thus, by virtue of the Act of 5 August 2022 Amending the Act on the Government Road Development Fund and Certain Other Acts, the existing ban was repealed in its entirety with immediate effect.

Transitional postponement, but with conditions

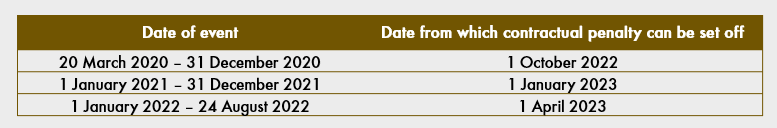

However, by way of transitional provisions, the act repealing Art. 15r1 provides for postponement of restoration of the practice of contracting authorities’ withholding contractual penalties from contract payments or drawing on a bank guarantee to satisfy the penalty. This will occur in three stages, depending on the date of the event giving rise to the contractual penalty.

But for the postponement to protect against drawing on a performance bond to satisfy a contractual penalty, the contractor must extend the validity of the bond at least 14 days before it expires, if the expiration is to occur more than 13 days before the date when deduction of the contractual penalty becomes possible.

For the benefit of contractors?

Public procurement contractors may feel disappointed, as overnight they were deprived of the ability to defend themselves against immediate enforcement of contractual penalties, even though the state of epidemic threat still remains in effect, and even though they had reason to assume that enforcement (by way of setoff from contractual payments or drawing on a bank guarantee) of contractual penalties incurred during the COVID-19 epidemic could not occur until three months after the threat of epidemic was formally revoked.

The drafters claim that the repeal of Art. 15r1 is in the interest of contractors, but it is hard to identify what interest that might be—especially since the rationale for introduction of the ban under Art. 15r1, special protection of contractors’ financial liquidity, has not disappeared. Indeed, the war in Ukraine since February 2022 is generating another risk affecting public procurement projects currently underway, including an increase in completion costs, which threatens to worsen the economic condition of businesses operating in the public procurement market.

A lost opportunity for closer partnership

The issue of contractual penalties in public procurement in Poland has been problematic for years. More often than not, the penalties do not perform their main compensatory function in procurement. Statistics collected by the Public Procurement Office show that in some 80% of cases, the irregularities that were the ground for imposing a contractual penalty had little or no impact on performance of the contract (according to the office’s 2018 report on contractual penalties—more in the article “A contractual penalty in public procurement is not damages”).

For the past two years, due to Art. 15r1, a new practice had a chance to start functioning in the public procurement market: if the contractor believed that the contractual penalty was not due or was incorrectly calculated, and refused to pay it, the contracting authority had to seek payment of the contractual penalty in court. This provided an opportunity for more collegial relations between the parties to public contracts, i.e. to enforce only contractual penalties that were factually and legally justified.

Art. 15r1 also increased the potential for reconciliation of claims for contractual penalties. As the need to pursue contractual penalties in court burdened the contracting authority, it was in the contracting authority’s interest to reach a settlement, allowing it to save litigation costs and obtain prompt payment. On the other hand, the provision did not eliminate the obligation to pay interest on contractual penalties paid after the due date, if the court found that the penalty was due. This motivated contractors to settle claims for accrued contractual penalties, rather than getting embroiled in protracted litigation.

Penalties again accrue automatically

The repeal of Art. 15r1 will restore the state in which the enforcement of contractual penalties by deduction from the contractor’s current invoices or drawing on bank guarantees will occur automatically. The contractor will then be able to demonstrate the defectiveness of the calculation and deduction of contractual penalties only by asserting a claim for payment. The contractor will also be solely burdened with the costs of initiating the proceedings and the consequences of deduction of penalties from the contractor’s fees (such as loss of financial liquidity).

It seems that the basic mistake underlying the effort to repeal Art. 15r1 was the assumption that contractual penalties charged by contracting authorities and enforced by setoff are always warrabted. It is clear from the Public Procurement Office report cited above that this is not the case. The statistical data show that in the absence of voluntary payment (including setoff) of the contractual penalty, only in a negligible number of cases did the contracting authority decide to seek payment of the contractual penalty in court (in contracts for construction works, 6% of cases; supplies 3%; services 2%). Juxtaposing this data with the obligation to pursue public receivables pursuant to the Act on Responsibility for Infringement of Public Finance Discipline, we would have to assume that more than 90% of assessed contractual penalties are not warranted. But after the repeal of Art. 15r1, this will not protect contractors from “payment” of these penalties.

Mirella Lechna-Marchewka, attorney-at-law, Infrastructure, Transport, Public Procurement & PPP practice, Wardyński & Partners