Starting professional activity in Poland—what about taxes and social insurance?

Employment contract, contract of mandate, or sole proprietorship (individual business activity): these are the most common forms of cooperation with individuals in Poland. In this article, we explain the tax and social insurance burdens for individuals working under an employment contract and contract of mandate. In the next article, we will discuss different forms of business income taxation.

Employment

Employment income is subject to progressive income tax of 17% and 32%, i.e. income (salary decreased by social insurance contributions financed by the employee and a fixed annual deduction of PLN 3,000) up to PLN 85,528 is taxed at 17%, and the excess above that amount is taxed at 32% (after taking account of potentially tax-exempt amounts).

Employment revenue is subject to social insurance contributions, which are financed partly by the employer and partly by the employee. The employer effectively bears a 20.48% contribution on top of gross salary (assuming that the accident insurance portion is 1.67%), while the employee bears a contribution of 13.71% of gross salary. The employee’s contributions are deducted from gross salary.

Additionally, the employee is required to pay health insurance contributions, but these premiums are to a great extent deductible from personal income tax.

In case of an employment contract, the employer is responsible for proper settlement of taxes and social insurance and health insurance contributions due from the employee (the employer withholds and remits these amounts; some exceptions may apply to non-Polish employers).

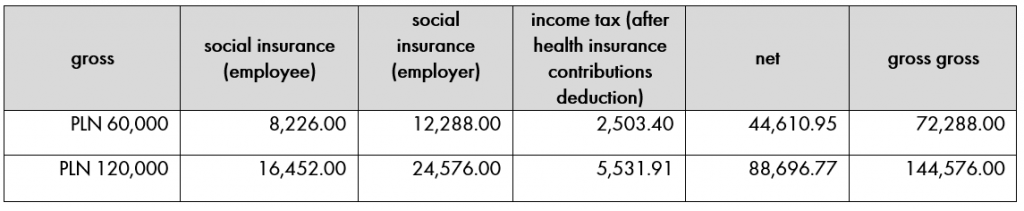

The table below shows a sample calculation of tax and social insurance burdens for employment salaries of PLN 60,000 and PLN 120,000 gross per annum.

Contract of mandate

In terms of tax and social insurance consequences, a contract of mandate (umowa zlecenia) is similar to an employment contract. For income tax, the only difference concerns the fixed tax deduction, which is equal to 20% of remuneration decreased by social insurance contributions (compared to a flat PLN 3,000 per year in case of employment).

In terms of social insurance, the sickness insurance contribution (2.45%) is not mandatory. In some cases, when an individual works under several separate contracts (e.g. employment but also a contract of mandate), social insurance contributions are due on the employment contract but not the others (except for health insurance contributions, which are due on both contracts).

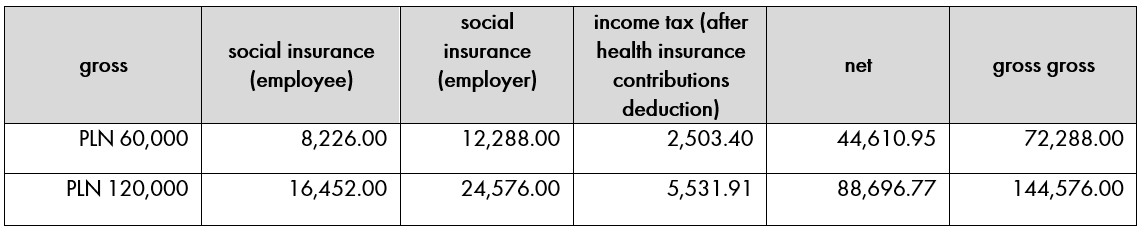

The table below shows a sample calculation of tax and social insurance burdens for contracts of mandate with a remuneration of PLN 60,000 and PLN 120,000 gross per annum (with sickness insurance contribution).

Super tax deduction for creative work

Working in some sectors may also lead to a right to apply a higher tax deductible expenses of 50%. This applies to creative work performed under an employment or mandate contract. The super deduction applies to remuneration for transfer of copyright to works created under contract. The super deduction can be claimed up to PLN 85,528 per year.

Examples of taxpayers who may benefit from this higher tax deduction are computer-game designers, software designers, and architects.

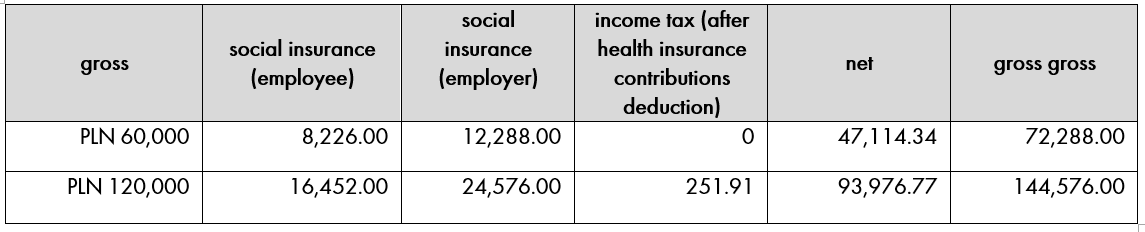

The table below shows a sample calculation of tax and social insurance burdens for employment salaries of PLN 60,000 and PLN 120,000 gross per annum when tax deductible expenses of 50% applies.

Becoming a Polish tax resident

An individual who starts to work in Poland should be aware that this may lead to a change in tax residency. Becoming a tax resident in Poland means that the individual is subject to taxation in Poland on his or her worldwide income, not just Polish-source income, such as employment income or income earned under a contract of mandate.

Polish tax law defines a domestic tax resident as an individual who has his or her centre of vital interests in Poland or stays in Poland for more than 183 days within a year.

Joanna Goryca, Tax practice, Wardyński & Partners