Renewable energy sources support system: Prices and volumes for renewables at auctions in 2022–2027

The first draft of the regulation on the maximum amount and value of electricity from renewable energy sources that may be auctioned in calendar years 2022–2027 in Poland was published on 5 July 2022. It is the first time such a regulation covers six consecutive years. This follows from the amendment to the Renewable Energy Sources Act spurred by industry voices asserting that announcing these values further in advance would allow developers to better prepare for the auction and thus offer more competitive prices.

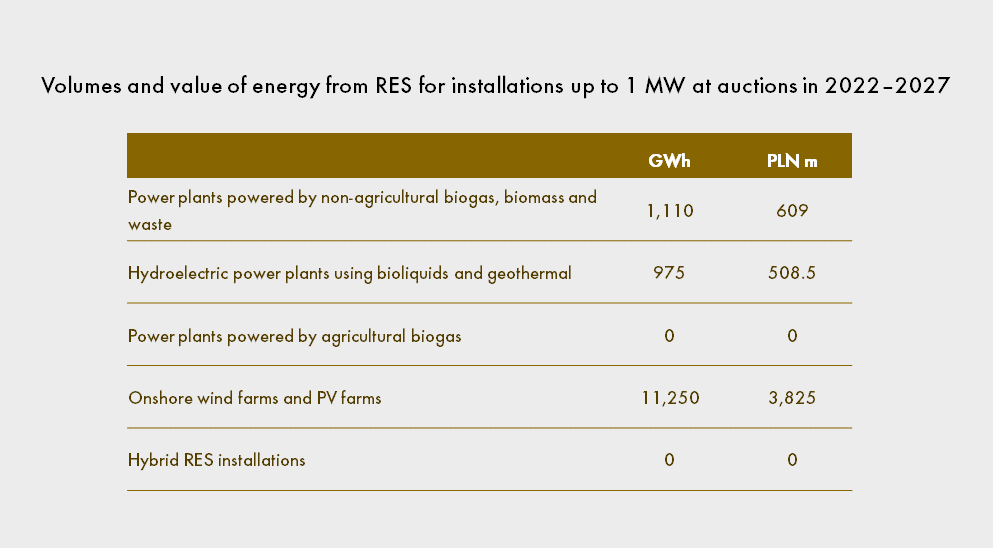

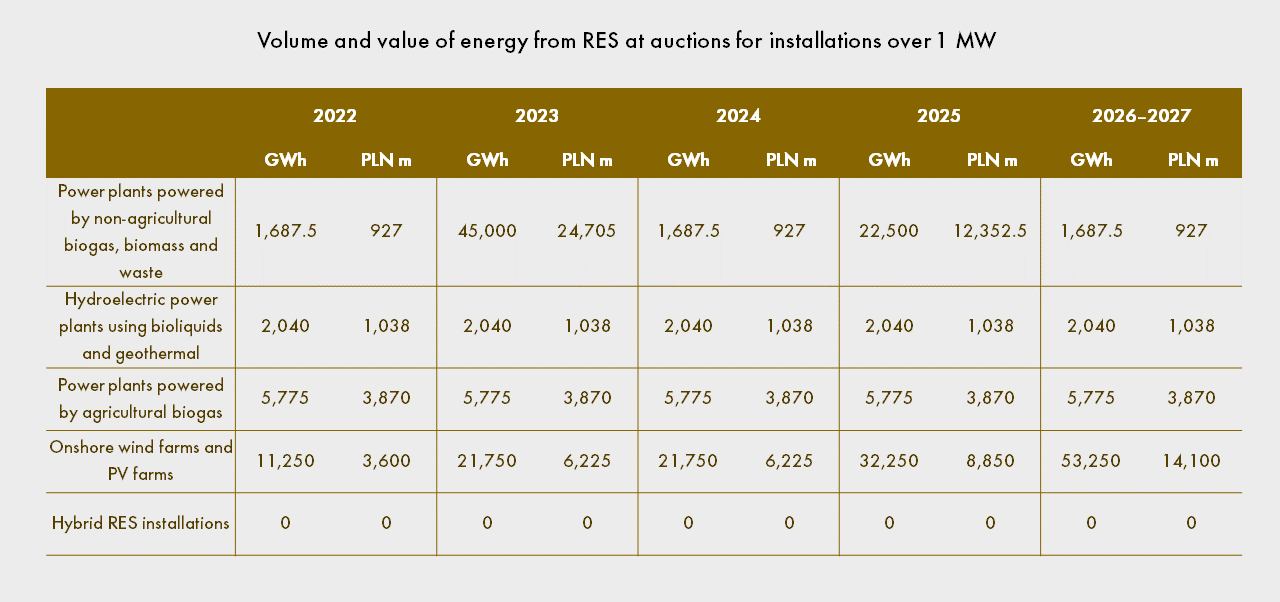

Under the regulation, the expected volume of energy offered at the auctions will total 394,650,000 MWh, which can be sold for a total of nearly PLN 153 billion. The drafters do not provide for a change in prices for energy offered at auctions in subsequent years. Most likely, this will mean keeping the reference prices at an unchanged level, which in the context of significant inflation may reduce the interest in participating in the auctions. This could also lead to effective abandonment of energy sales under the auction system, as at the current electricity prices on the Polish Power Exchange it is more profitable for generators to pay a penalty for failing to report energy sales to the clearing manager (the state-owned company Zarządca Rozliczeń SA) than to hand over a positive balance at the end of the support period.

According to the plans of the Ministry of Climate and Environment, the volumes offered should result in construction of new installations with the following capacities:

- 3,000 MW of onshore wind farms (250 MW/year from the 2023–2024 auction, 500 MW from the 2025 auction, and 1,000 MW/year from the 2026–2027 auctions)

- 9,000 MW of PV farms—4,500 MW of PV farms with a capacity up to 1 MW and 4,500 MW of PV farms with a capacity above 1 MW (750 MW each from both capacity baskets per year in 2022–2027)

- 120 MW of hydroelectric power plants with a capacity larger than 1 MW (20 MW per year) and 60 MW of hydroelectric power plants with a capacity up to 1 MW (10 MW per year)

- 660 MW of power plants powered by non-agricultural biogas, biomass and waste with a capacity greater than 1 MW (15 MW/year in 2022, 2024 and 2026–2027, 400 MW/year in 2023, and 200 MW/year in 2025) and 60 MW of power plants powered by non-agricultural biogas, biomass and waste with a capacity of up to 1 MW (10 MW per year)

- 300 MW of agricultural biogas plants with a capacity larger than 1 MW (50 MW per year).

Under the auction system, the drafters would withdraw support from small biogas plants with a capacity of 1 MW or less. However, the experience to date indicates that the use of feed-in-tariff and feed-in-premium systems is far more popular among generators using this technology. Also, the drafters did not choose to support hybrid RES installations, despite intense work on amending the definition of this type of installation.

Will investors participate in the upcoming auctions?

The current situation in the European energy market, where there is a shortage of energy, calls into question whether there will be investors willing to participate in the auction system at the maximum prices offered. Energy prices on the free market are several times higher than the prices proposed in auctions two or three years ago. Therefore, many investors who won auctions in the previous years are analysing the options for not entering the support system, being excluded from the system, formally exiting the system if they are already in it after building a power plant, or minimising their sales of energy produced under the support system. It should be noted that a generator who obtains more revenue from the sale of energy than the prices offered at the auction is obliged to turn over the surplus to Zarządca Rozliczeń SA.

Perhaps some investors will participate in the system to sell a small portion of their volume under the support system, guaranteeing themselves a fixed income stream, while continuing to sell the rest of their volume on the open market outside the support system.

Igor Hanas, adwokat, Energy practice, Wardyński & Partners

Rafał Pytko, Energy practice, Wardyński & Partners