Damages for victims of criminal offences can be sought not only from the perpetrator

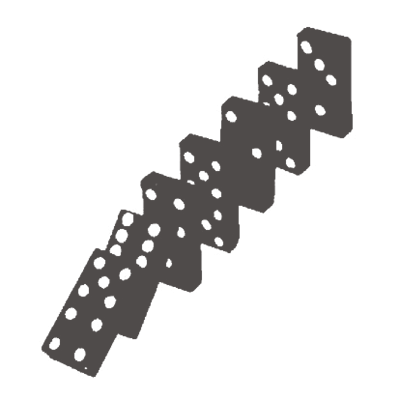

The possibility of seeking damages from a person who has knowingly benefited from a wrong done to another may offer the victim the only practical chance of obtaining even partial recompense. Often the immediate wrongdoer is insolvent, while someone else gains from the unlawful act.

The situation of lessees and tenants in execution and bankruptcy proceedings

If execution or bankruptcy proceedings are commenced against the owner of leased or tenanted real estate, the lease or tenancy contract may be terminated early by the administrator or trustee. Rent paid in advance may then be deemed ineffective. How should lessees and tenants protect themselves when entering into a contract with an owner in poor financial condition?

The creditor’s inappropriate attitude can save the debtor

The Supreme Court has held that in exceptional cases, the creditor’s conduct in enforcement proceedings will constitute an abuse of law justifying denial of the creditor’s right to execute an order. Therefore, the creditor’s inappropriate attitude may make it impossible to enforce a claim awarded by a final court decision.

Possible consequences of aiding a dishonest debtor

Liability for money laundering in the case of persons assisting in actions taken by dishonest debtors to the detriment of creditors.

The bank will transfer attached funds to the bailiff, but not right away

Less than two weeks ago the Act of 13 April 2018 Amending the Civil Code and Certain Other Acts reached the desk of the President of Poland. The act has become the subject of debate, as it calls for shortening of the general limitations periods for claims and modifies the ability of enterprises to pursue claims against consumers after the limitations period expires. There is also a change in execution procedure affecting the ability to conduct electronic attachment of the debtor’s bank account.

A portfolio of receivables as collateral: Pledge or assign?

In various types of financing transactions, one of the borrower’s main assets is a portfolio of receivables, e.g. under leases (when financing commercial property) or under loans (when the borrower is in the business of granting loans). In such cases, the lender seeking effective security will often require such a portfolio to serve as collateral.

Liability for representations and warranties concerning the condition of the company in a corporate sale

Making false representations about the state of tax liabilities of a company being sold may make it necessary to cover the buyer’s losses, even years after the transaction.

Reservation of title to sold goods

Reservation in the sales contract of ownership of the goods until full payment of the purchase price by the buyer increases the security of a supplier of raw materials and semi-finished products to a customer threatened with insolvency.

The position of the security agent in in-court restructuring proceedings

What banks should pay attention to when granting consortium financing or considering restructuring of consortium debt.

Pre-packaged insolvency: A new debt recovery tool for financial institutions in Poland?

The pre-packaged insolvency (“pre-pack”) may become an effective debt recovery tool for financial institutions who are secured creditors, when the debtor is insolvent and the lender seeks to quickly cash out its collateral at the best price. This can also apply when in-court restructuring proceedings for the debtor are commenced but then discontinued.

The owner does not always have to pay the holder for improvements to property

An interesting ruling was issued in a case we were handling. After the independent possessor of real estate turned the property over to the owner, it demanded payment for the expenditures it had made on the property, including construction of a building on the site. But does construction always raise the value of the property?

The European account preservation order

Creditors can now attach debtors’ bank accounts under uniform rules across all EU member states.