Dr Kinga Ziemnicka-Klebba

Businesses’ contractual obligation in a time of pandemic

16.03.2020

coronavirus, contract

Numerous sectors of the economy have been paralysed. The problem is not just closings or restricted access to a range of services, but also absence of staff due to illness, quarantine or childcare. Consequently, businesses cannot operate normally or perform their obligations on time. A lack of supplies by one company often carries over to an inability of its customers to fill their own orders. This bogs down the whole economy. We await systemic solutions allowing Polish businesses to survive. But before they arrive, it’s a good time to examine the regulations currently in force.

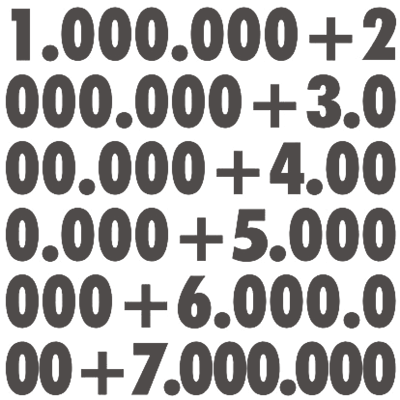

The long and winding road to lawful distribution of dividends

08.03.2018

corporate, M&A

The process leading up to payment of dividends by a company, although highly formalised, is familiar to the players and should not present great difficulties. But it nonetheless requires vigilance, because failure to comply with the statutory requirements can have serious consequences, particularly as it is easy to fall afoul of the changing regulations.

Transferring the registered office of a Polish company abroad does not require the company to be liquidated in Poland

30.11.2017

corporate, European Court of Justice

The Court of Justice has ruled that under the EU principle of freedom of establishment, transfer of the registered office of a Polish company abroad within the European Economic Area cannot be conditioned on conducting liquidation of the company in Poland.

Advance dividend: When can the company demand a refund?

25.11.2016

corporate

Payment of an advance against anticipated dividends is attractive for shareholders but carries a major risk, particularly for the company. At the end of the financial year it may turn out that there is no basis for paying a dividend. Then can the company require the shareholders to return the advance?

Contributions to share capital in foreign currency and foreign exchange differences

02.06.2016

corporate

With economic globalisation, foreign investors often decide to pay capital contributions to Polish companies in foreign currencies. This raises the question of how to convert these amounts into Polish currency.

What to pay attention to when outsourcing accounting services

29.05.2013

outsourcing

As a taxpayer, a business remains liable for tax obligations even when it hires an external professional service company to maintain its accounting books.

Preliminary agreement for real estate transaction without a shareholder resolution?

05.01.2012

real estate, corporate

A company may enter into a preliminary agreement to buy or sell real estate without obtaining shareholder approval, but the lack of a shareholder resolution will prevent the parties from seeking a court order enforcing the promise to go through with the t

Conversion of a sole trader into a capital company

27.10.2011

corporate

It is now possible for a person conducting business as an individual to convert the business into a single-shareholder company, carrying over most elements of the existing business—except tax breaks.

Maintaining and storing Polish company accounts outside Poland

26.05.2011

corporate

Under recently amended provisions of the Polish Accountancy Act, authorised entities outside Poland may maintain and store accounts of Polish companies—but only in compliance with Polish accounting requirements.